In a rapidly changing and expanding market, CheckMyBus is committed to sharing knowledge of the intercity bus sector with the global bus community. With developments, such as the shift to online booking, dynamic pricing, and digital transformation, the industry is constantly evolving. Furthermore, are able to use our position as the world’s largest meta-search engine for bus and coach travel to spot current trends in the industry and provide world-class insights. Accordingly, you can find webinars hosted by Busworld Academy below in addition to charts and graphs about the bus market.

Market Studies

Based on our data on routes, prices, and user behaviour in various bus markets around the globe, we do regular research and publish market studies for bus and coach.

Portugal: Bus ticket price study comparing 2019, 2021, and 2022.

March 2023 – Average prices for 5 routes in the Portuguese express bus market have seen a small increase in 2022 compared to 2021, but are still below 2019 pre-COVID prices. The changes with the opening of the market at the end of 2019 seem to have reflected in ticket prices because of strong battle of offers. (For the portuguese version of the study just click here)

Brazil: Bus Ticket Price study comparing 2019, 2021, and 2022.

February 2023 – Prices in the Brazilian coach market are increasing compared with 2021, but still are below pre-COVID prices. Increased competition appears to drive prices lower. The study continues looking at key selected routes in Brazil.

Brazil: Price study Q1/2022

April 2022 – Prices in the coach market are decreasing due to new entrants and more competition compared to pre-Covid times. The study looks into selected key routes in Brazil.

Chile: Online growth analyses

April 2022 – Consumer behavior shifted from offline to online. This leads to a strong increase of online sales versus 2019. The analyses look at overall growth for the country, by route and also compares operators (anonymized)

South East Asia: Recovery analyses and prediction

April 2022 – How does demand for international tourism bounce back in South East Asia? The research contains major destinations in South East Asia and compares non-domestic demand with Europe.

Spain: Price analyses

March 2022 – Average prices for long-distance routes in Spain decrease. Reason is more competition of low-cost trains providing price pressure to the bus sector.

Brazil: Price analyses 2021 compared to 2019

March 2022 – Major routes in Brazil have become more competitive with new entrants and more price agressive players. This reduces overall price level by up to 60% on major bus lines.

Global Bus – Online Demand Index

Feburary 2022 – How did user demand for bus develop the last years and what is the prediction for 2022 by country? The reasearch takes user data and normalises it by taking out market share changes.

Bus Industry Webinars

We are always happy to share our platform with experts in the industry throughout the world to share insights, business practices, and success stories. Moreover, we’re proud of our latest partnership with Busworld Academy to host different webinar series. These will cover a range of topics. In brief, from digitization to adapting to changing market trends and environmental consciousness, our goal is to put some of the brightest minds in the transportation sector together to discuss, share and inspire their peers.

More about the webinar

Part4

About: In summary, experts in the bus and coach industry discuss digital strategies and share their real world examples with the global bus community.

Speakers:

- Inge Buytaert, BAAV

- Johannes Thunert, Distribusion Technologies

- Marc Hofmann, CheckMyBus

- Sebastian Gomez, Reservamos

- Sanjeeb Ranjan, redBus

- Marko Javornik, Voyego – part of Endava

More about the webinar

Part 3

About: In summary, experts in the bus and coach industry discuss digital strategies and share their real world examples with the global bus community.

Speakers:

- Juan Pablo Martín, Grupo Flecha Amarilla

- Rajanvir Singh Kapur, West Bengal Transport Corporation

- Mike Van Horn, Betterez

- Andres Osula, Turnit and Elvir Rascic, VuBus4You

More about the webinar

Part 2

About: In summary, experts in the bus and coach industry discuss digital strategies and share their real world examples with the global bus community.

Speakers:

- Paola Daddato, Innovation and Digital Marketing Lead, Flibco.com

- Paolo Beria, Associate Professor of Transport Economics TRASPOL, Politecnico di Milano

- José Juan Cicca, Commercial Director, Turismo Civa

- Walter Dabbicco, Marketing Manager and Marika Tota, Customer Satisfaction, MarinoBus

More about the webinar

Part 1

About: In summary, experts in the bus and coach industry discuss digital strategies and share their real world examples with the global bus community.

Speakers:

- Marc Hofmann, CEO, CheckMyBus

- John Boughton. Commercial Director, National Express

- Joel Cardenas, Digital Transformation Project Manager, Mobility ADO

- Max-Alexander Borreck, Principal Transportation, Oliver Wyman

- Barak Sas, Head of International Expansion, Zeelo

Bus Market Recovery

In March 2020, we began to observe drastic changes in user demand and ticket sales in the bus market due to the worldwide COVID-19 crisis.

In the weeks and months that followed, we compiled our data to give an outlook to the larger global bus community. Additionally, we regularly posted updates to our company LinkedIn page.

After several months of observing the data, we were able to draw some conclusion:

- User demand will rise in countries with an improving COVID-19 situation (i.e. less cases) and user demand will fall in countries with a worsening COVID-19 situation (i.e. more cases).

- Demand returns at a rapid rate once restrictions are lifted.

- Ticket sales follow the same trend as user demand. However, sales are directly related to the supply of tickets that are available.

Below are several of the charts and graphs we put together outlining the impact on the bus market, and the subsequent bus market recovery.

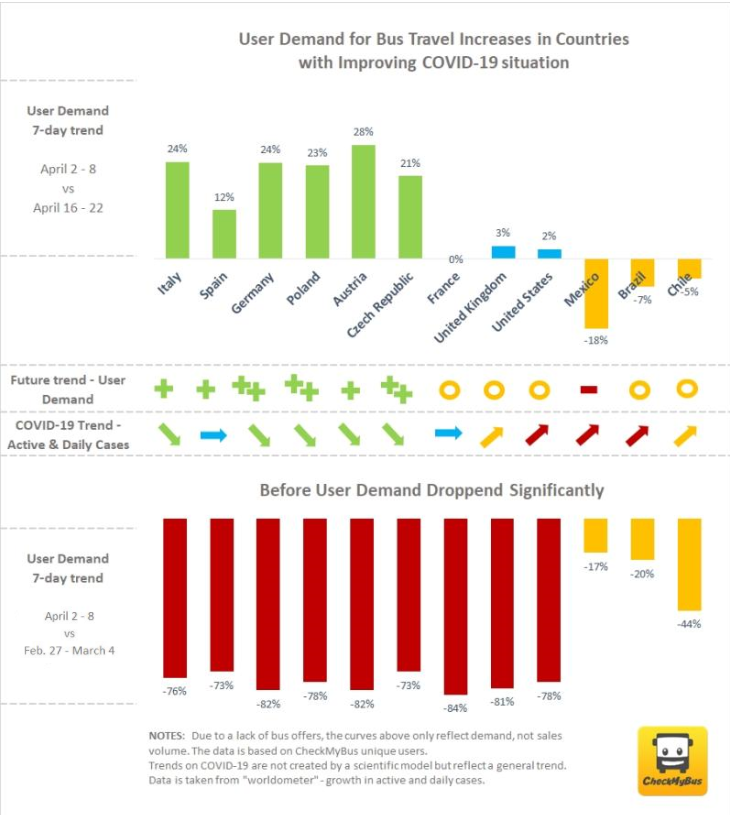

We used the week of February 27 – March 4 as a benchmark for ‘normal’ bus market operations. Next, we compared this data to April 2 – April 8 which was the height of the COVID-19 epidemic in Europe, specifically and the beginning of outbreaks in LATM.

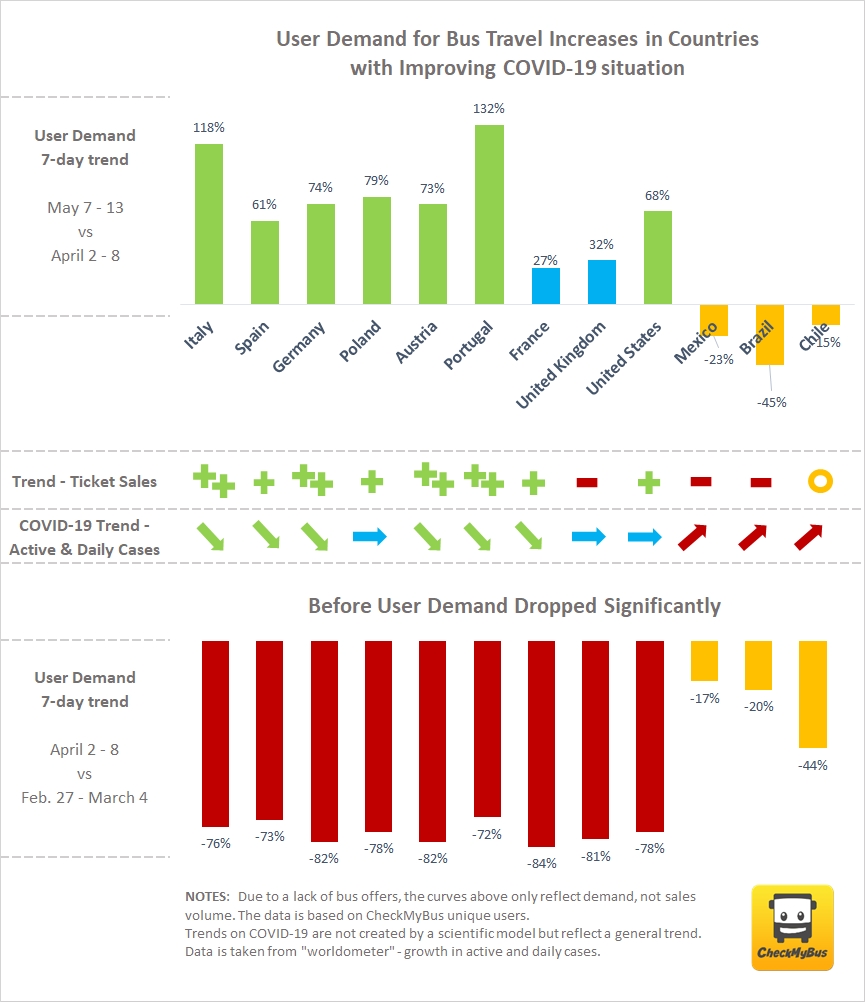

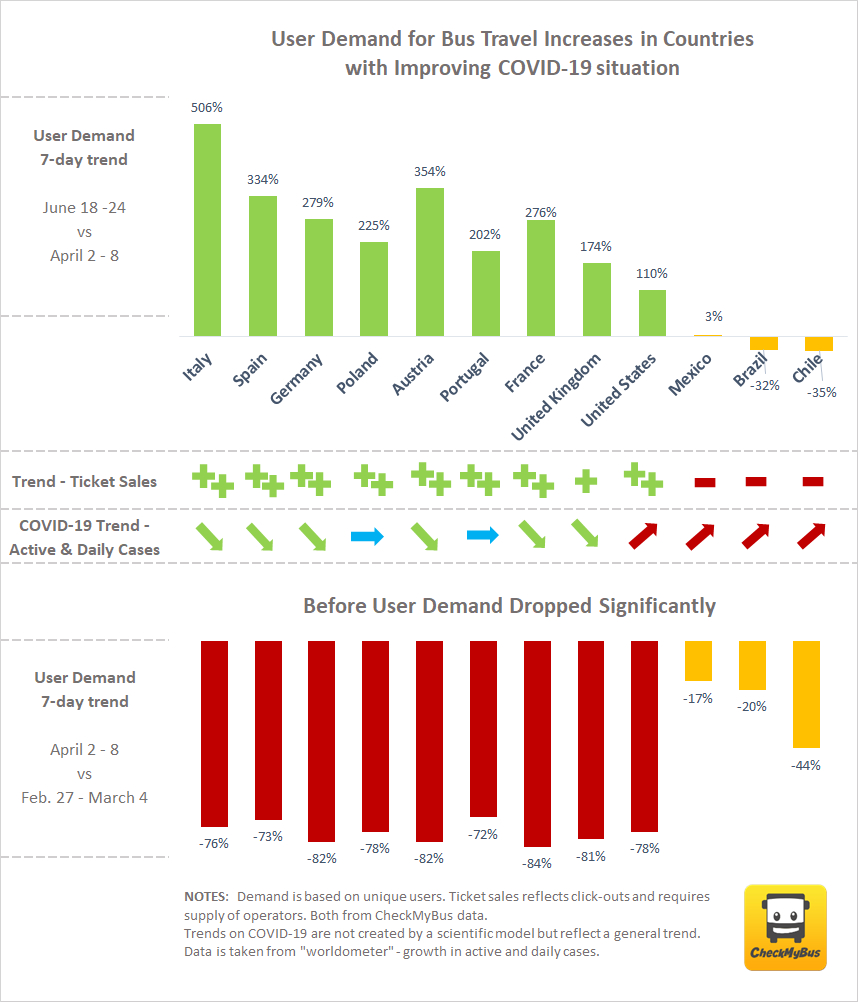

The week from April 2 – April 8 was used as a benchmark to show the increase or decrease on demand in weeks that followed.

Bus Market Recovery

April 16-22, 2020

Notes: As the COVID-19 situation began to slowly improve in Europe, many countries saw a slight uptick in user demand when compared to April 2-8. Note: This initial graph did not include a trend for ticket sales.

May 7-13, 2020

Notes: The trend we saw in April continued into May, as we saw an increased decline in LATM countries (Mexico, Brazil, Chile). In contrast, European countries continued to see demand increases and a trend for increased ticket sales.

May 28-June 3, 2020

Notes: This update saw a massive climb in user demand in places like Italy, with a 300% increase. At this time COVID was rapidly improving compared to the hardest hit days during full lockdown.

June 18-24, 2020

Notes: This was our last published update. The correlation between user demand for bus travel and improving COVID-19 situation was clear. LATM countries saw a decline while European countries demand was still on the rise.

Contact Us

If you have any questions regarding our bus market research or you are interested in becoming a CheckMyBus partner, where you’ll enjoy benefits such as, increased customer traffic to your website, worldwide exposure on 21 separate CheckMyBus domains and above-average conversion rates, please get in touch by emailing us at partner@checkmybus.com.